Cashless Resort

-

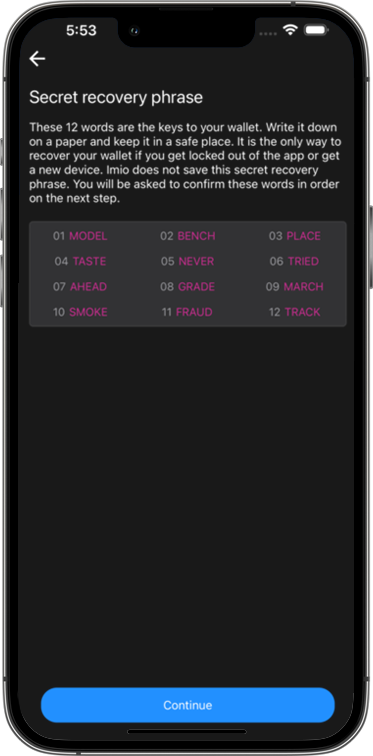

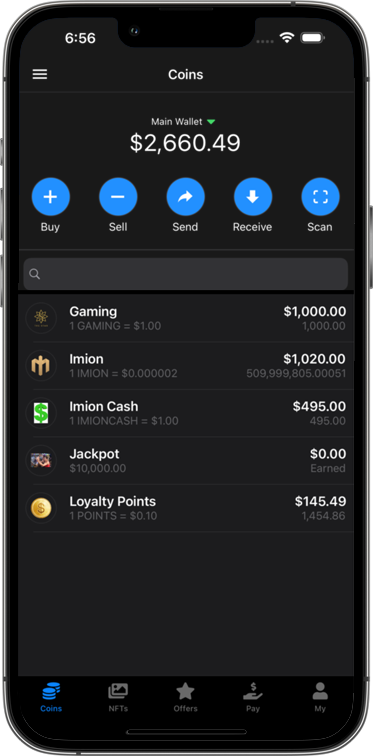

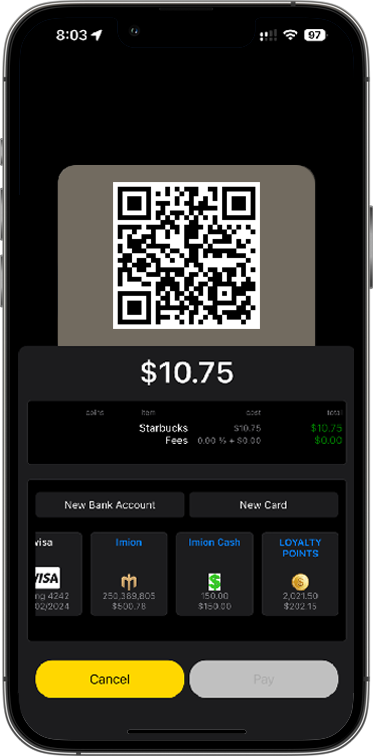

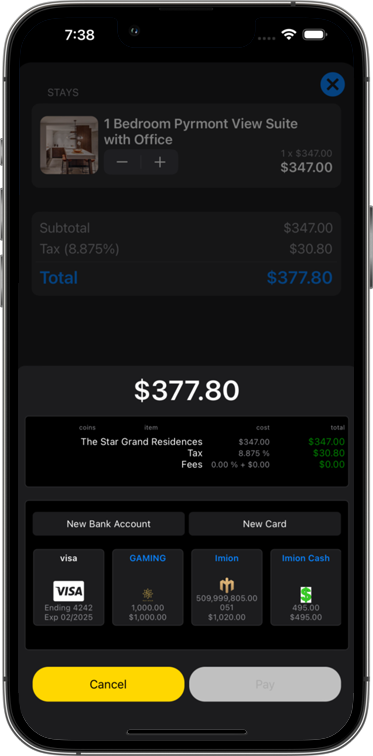

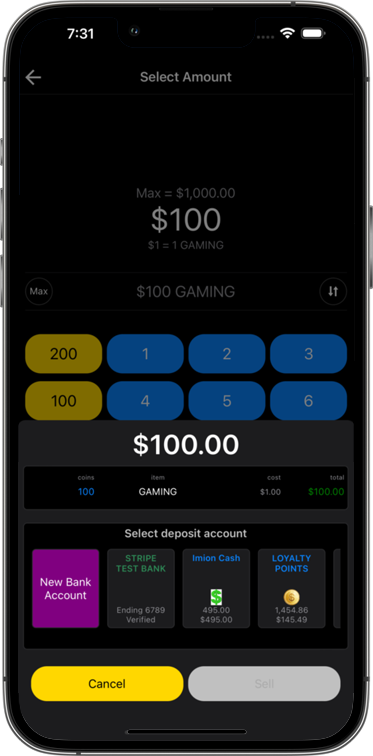

Enable your customer’s mobile device to be an Universal Wallet / EFTPOS (Electronic funds transfer point of sale) across your resort – link credit/debit cards, bank accounts, crypto currencies, loyalty points etc., to the wallet - providing security, convenience and visibility to all customer spend and move towards a 100% cashless environment

-

Enhanced financial security by registering all currency transactions and contracts with a private blockchain, - facilitating AML (anti-money laundering) initiatives within your business

-

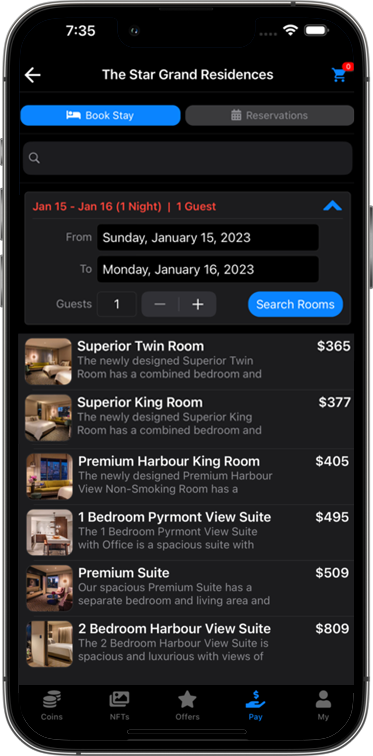

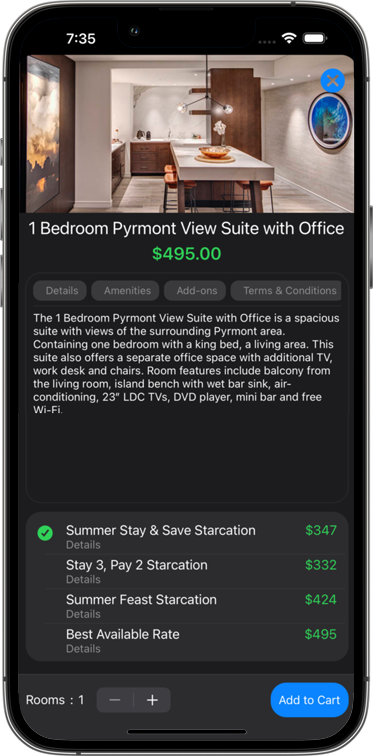

Allow your customers to fund with their wallet for amenities (retail outlets, hotel, restaurants, and events) within the casino resort - providing a seamless customer experience

-

Turn your Customer’s mobile device into a physical identification device using biometric AI - replace loyalty cards, driver license, passport etc., for authentication and authorization